Due in part to President Donald Trump‘s crypto-friendly stance and the ongoing trade negotiations his administration has been holding with New Delhi, India’s cryptocurrency industry is stepping up lobbying efforts to lower the onerous levies that have hindered domestic commerce for years.

In contrast to a legislative structure that was more hostile to digital assets, the majority of business stakeholders believe that Prime Minister Narendra Modi’s administration is now more receptive to them.

Since 2022, India has imposed stringent taxes on cryptocurrency transactions, including a 30% capital gains tax and a 1% tax deducted at source (TDS) on every crypto transaction. These measures were introduced to curb the illicit use of digital assets but have significantly dampened domestic trading activity. Industry reports suggest that over 90% of Indian crypto trading has shifted offshore due to these harsh tax burdens, undermining the growth of India’s crypto ecosystem and reducing government oversight and tax revenue potential.

The Reserve Bank of India forbade banks from offering service accounts in 2018. But after a two-year court struggle, the Indian Supreme Court declared the RBI restriction to be unconstitutional, allowing banks to once more provide services to cryptocurrency firms.

The primary demand from India’s crypto industry is a significant reduction in the capital gains tax and the TDS on crypto transactions. Industry representatives argue that the current 30% tax rate is excessively high compared to other investment classes, such as equities, and stifles retail and institutional participation.

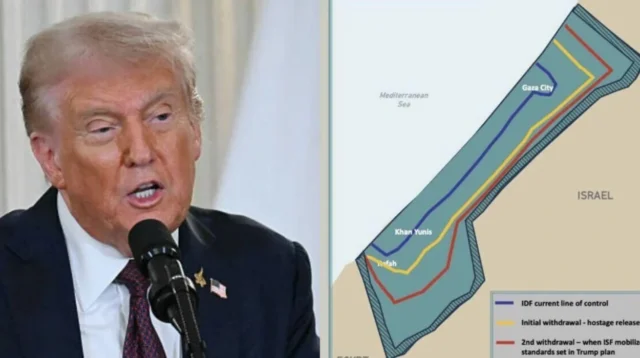

Trump’s return to the White House and his outspoken support for crypto innovation appear to be in line with the recent change. Industry insiders claim that this abrupt shift in strategy is not an accident.

Additionally, communication with Indian policymakers has greatly strengthened. They now meet with the industry “monthly, if not weekly.” Reexamining the harsh tax system—a 30% capital gains tax and a 1% transaction tax—which has caused more than 90% of India’s cryptocurrency trade to go abroad remains the primary objective.

Coinbase and Binance have returned to the market. Both businesses had previously withdrawn from the market due to unclear regulations. Since many MPs are gradually coming around to the notion, Coinbase sees India as a critical development location and has just received major regulatory permission.

Moreover, the warming attitude toward crypto in India is partly attributed to ongoing trade negotiations and closer economic ties with the United States. New Delhi policymakers are encouraged to link more near with US regulatory trends to attract foreign investment and foster innovation in the digital asset space. This alignment is encouraging India’s crypto sector to intensify lobbying efforts in the U.S. to gain support for tax reforms and regulatory clarity that could benefit both countries’ crypto markets.